Protecting your company is essential. With the right commercial insurance coverage, you can Ontario Business Insurance for Small Businesses minimize your financial threats. In Ontario, obtaining the perfect policy doesn't have to be a complicated task. Leverage our no-cost online tool to compare quotes from top insurance providers in just minutes.

- Find the most affordable coverage options available to align your specific needs.

- Safeguard your assets from unexpected events, such as destruction.

- Benefit from peace of mind knowing your business is well-protected.

Hesitate to contact our insurance experts if you have any questions. We're here to support you every step of the way.

Oshawa Brokers Expand Expertise to Meet Growing Ontario Business Insurance Needs

As the Canadian business landscape progresses, Oshawa Brokers are effectively expanding their expertise in the field of business insurance. Observing the increasing demand for comprehensive coverage options, Oshawa Brokers are committed to providing clients with tailored solutions that mitigate their unique risks. This dedication to client success is evidenced by the ongoing development in specialized programs for their team, ensuring they stay at the forefront of industry trends and best practices.

Ontario's Commercial Insurance Landscape: Navigating the Rough Waters

Ontario's enterprise insurance industry is currently facing a turbulent period. Underwriters are witnessing increasing claims, driven by factors such as economic uncertainty. This situation is putting strain on costs, making it more challenging for businesses to secure the protection they need.

Surmounting this terrain requires a strategic strategy. Businesses should carefully analyze their exposures, shop around from various insurers, and work with an qualified advisor to find the most suitable coverage.

Find Ontario Business Insurance Premiums and Discover the Best Deal

Running a business in Ontario comes with its fair share of responsibilities, and ensuring you have adequate insurance coverage is paramount. With numerous coverage providers available, it can be overwhelming to determine the most beneficial option for your specific needs. The good news is that by taking the time to compare Ontario business insurance premiums, you can unlock significant savings without neglecting crucial coverage.

To make this process more manageable, consider utilizing online comparison tools that allow you to submit your business details and receive quotes from multiple insurers side-by-side. This can give you a clear picture of the market landscape and help you identify potential cost differences. Don't hesitate to speak with different insurance brokers to clarify coverage options, terms and conditions, and any other queries you may have.

By carrying out thorough research and diligently comparing Ontario business insurance premiums, you can maximize your chances of finding the best deal that provides comprehensive protection for your enterprise.

Saving Strategies : Affordable Business Insurance Quotes in Ontario

Ontario companies are always on the lookout for ways to cut expenses. One area where many find significant savings is with business insurance. Obtaining affordable quotes can be a straightforward process if you are aware of the right strategies and resources.

Secondly, compare quotes from multiple insurers. Don't just go with the initial option you find. Take your time to research different insurers and compare their coverage options and pricing.

Afterward, think about your specific business needs. What type of insurance coverage do you actually need? Refrain from buying unnecessary coverage that will only increase your premiums.

In conclusion, look for discounts and incentives. Many insurers offer discounts for things like risk management. Via being proactive and taking the time to compare quotes, you can find affordable business insurance quotes in Ontario that satisfy your needs.

Protecting Your Success: Essential Business Insurance for Ontario Companies

Running a thriving business in Ontario is a rewarding journey, but it's crucial to safeguard your hard work and investments. A comprehensive business insurance policy acts as a vital safety net against unforeseen circumstances that could hinder your operations.

From asset damage to legal claims, the right coverage can help you bounce back financial losses and minimize disruptions to your workflow. Consider these essential insurance types:

- Commercial General Liability: Protects against demands arising from bodily injury or asset damage caused by your operations.

- Property Insurance: Provides coverage for your building, machinery, and stock against loss from fire, theft, vandalism.

- Product Liability Insurance: Safeguards you against claims related to harm caused by your products that result in loss.

Consulting with an experienced insurance agent can help you determine the specific coverage needs for your particular Ontario enterprise. Don't leave your success to chance - secure the right insurance to guarantee peace of mind and defend your valuable investments.

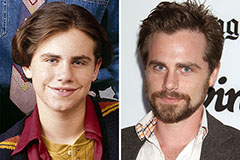

Rider Strong Then & Now!

Rider Strong Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Danica McKellar Then & Now!

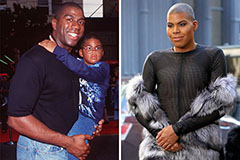

Danica McKellar Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now!